Learn More about Benefits, Rates and Minimums

-

eOne Savings

-

Open eOne Savings

eOne Savings

5.01%APY1

On every dollar for balances up to $1,000,000

eOne Savings

- Earn an industry-leading rate of 5.01% APY* with absolutely no commitment.

- Open in minutes with just a $10 deposit

- No minimum balance and no monthly fees

- The first $250,000 per depositor is insured by the FDIC

- High-yield savings account

Added Benefits

- No commitment - move money in and out whenever you want

- Free Online Banking and mobile banking app

- Mobile deposit and text alerts

- External transfers to move money easily

-

-

What You Will Need to Open Account

To apply, you will need:

- Social Security Number

- Driver's License Number

- Home Address

- Email Address

- Joint Owner Information

To fund a new account by electronic transfer, you will need:

- Name of Bank or Financial Institution

- Routing Transit Number

- Account Number

-

What You Will Need to Open Account

-

eOne Savings eligibility is limited to consumers who apply online and who do not have an existing checking or savings account with Salem Five Bank at the time of the application. Consumers with an existing eOne Checking Account are eligible for the eOne Savings Account.

1eOne Savings earns 5.01% APY (Annual Percentage Yield) on daily balances of $0.01-$1,000,000 and must be opened with funds not previously on deposit with Salem Five or Salem Five Direct. Salem Five reserves the right to transfer balances over $1,000,000 to a Statement Savings Account which currently earns an APY of .01%. eOne Savings may be used to provide overdraft protection for eOne Checking.

You must deposit at least $10 to open this account. The stated APY applies to new eOne accounts opened as of today's date. Fees may reduce earnings.

-

-

eOne Checking

-

Open eOne Checking

eOne Checking

.01%APY1

On every dollar for balances up to $1,000,000

eOne Checking

- Online Checking account without a monthly fee or hoops to jump through.

- Cash back on all your non pin-based purchases with your debit card

- Free ATMs**

- FDIC insurance to protect your entire balance

- No minimum balance

Added Benefits

- Free Online bill payment

- Mobile Check Deposit

- Free first order of checks

-

-

What You Will Need to Open an Account

To apply, you will need:

- Social Security Number

- Driver's License

- Home Address

- Email Address

- Joint Owner Information

To fund a new account by electronic transfer, you will need:- Routing Transit Number

- Account Number

-

What You Will Need to Open an Account

-

eOne Checking eligibility is limited to consumers who apply online and who do not have an existing checking account with Salem Five Bank at the time of the application. Account must be opened with funds not currently on deposit with Salem Five Bank.

1eOne Checking earns 0.01% APY (Annual Percentage Yield) on daily balances of $0.01 - $1,000,000. Salem Five reserves the right to transfer balances over $1,000,000 to the eOne Funding Account which currently earns an APY of 0.10%.

**With an eOne Checking Account, Salem Five will never charge a fee for ATM transactions conducted at non-Salem Five ATMs, and we will reimburse the fees other banks charge up to $15 per statement cycle.

You must deposit at least $10 to open this account. The rate may change after the account is opened. The stated APY applies to new eOne accounts opened as of today's date. Fees may reduce earning. Rewards apply to point-of-sale, non-PIN based debit card transactions (when you choose “credit”) with no minimum purchase amount and no cap to the cash rewards you may earn. ATM and PIN based transactions do not qualify. Cash Debit Rewards is at the rate of $0.05 for each debit card purchase (when you choose “credit”). Rewards accrued are credited to your account on the last day of the statement cycle in which the purchase is posted. Your account must be open and in good standing on the date the rewards are posted to receive the reward. We reserve the right to deduct rewards credits if you return merchandise for which you have qualified or received debit rewards. Any taxes related to debit rewards are the recipient’s sole responsibility. Program may be terminated at any time at our sole discretion. This offer is not available at Salem Five branch locations. Consumer accounts only.

-

-

eOne Savings/Checking Combo

eOne CheckingTM and eOne SavingsTM

This bundled combo includes the eOne Checking and the eOne Savings account for additional value. Easy online application for opening multiple accounts.

- Open Combo

eOne Savings

5.01%APY1

On every dollar for balances up to $1,000,000

eOne Checking

.01%APY1

On every dollar for balances up to $1,000,000

-

-

What You Need to Open Account

To apply, you will need:

- Social Security Number

- Driver's License Number

- Home Address

- Email Address

- Joint Owner Information

To fund a new account by electronic transfer, you will need:- Name of Bank or Financial Institution

- Routing Transit Number

- Account Number

-

What You Need to Open Account

-

eOne Savings eligibility is limited to consumers who apply online and who do not have an existing checking or savings account with Salem Five Bank at the time of the application. Consumers with an existing eOne Checking Account are eligible for the eOne Savings Account.

1eOne Savings earns 5.01% APY (Annual Percentage Yield) on daily balances of $0.01-$1,000,000 and must be opened with funds not previously on deposit with Salem Five or Salem Five Direct. Salem Five reserves the right to transfer balances over $1,000,000 to a Statement Savings Account which currently earns an APY of .01%. eOne Savings may be used to provide overdraft protection for eOne Checking.

You must deposit at least $10 to open this account. The stated APY applies to new eOne accounts opened as of today's date. Fees may reduce earnings. -

eOne Checking eligibility is limited to consumers who apply online and who do not have an existing checking account with Salem Five Bank at the time of the application. Account must be opened with funds not currently on deposit with Salem Five Bank.

1eOne Checking earns 0.01% APY (Annual Percentage Yield) on daily balances of $0.01 - $1,000,000. Salem Five reserves the right to transfer balances over $1,000,000 to the eOne Funding Account which currently earns an APY of 0.10%.

**With an eOne Checking Account, Salem Five will never charge a fee for ATM transactions conducted at non-Salem Five ATMs, and we will reimburse the fees other banks charge up to $15 per statement cycle.

You must deposit at least $10 to open this account. The rate may change after the account is opened. The stated APY applies to new eOne accounts opened as of today's date. Fees may reduce earning. Rewards apply to point-of-sale, non-PIN based debit card transactions (when you choose “credit”) with no minimum purchase amount and no cap to the cash rewards you may earn. ATM and PIN based transactions do not qualify. Cash Debit Rewards is at the rate of $0.05 for each debit card purchase (when you choose “credit”). Rewards accrued are credited to your account on the last day of the statement cycle in which the purchase is posted. Your account must be open and in good standing on the date the rewards are posted to receive the reward. We reserve the right to deduct rewards credits if you return merchandise for which you have qualified or received debit rewards. Any taxes related to debit rewards are the recipient’s sole responsibility. Program may be terminated at any time at our sole discretion. This offer is not available at Salem Five branch locations. Consumer accounts only.

-

-

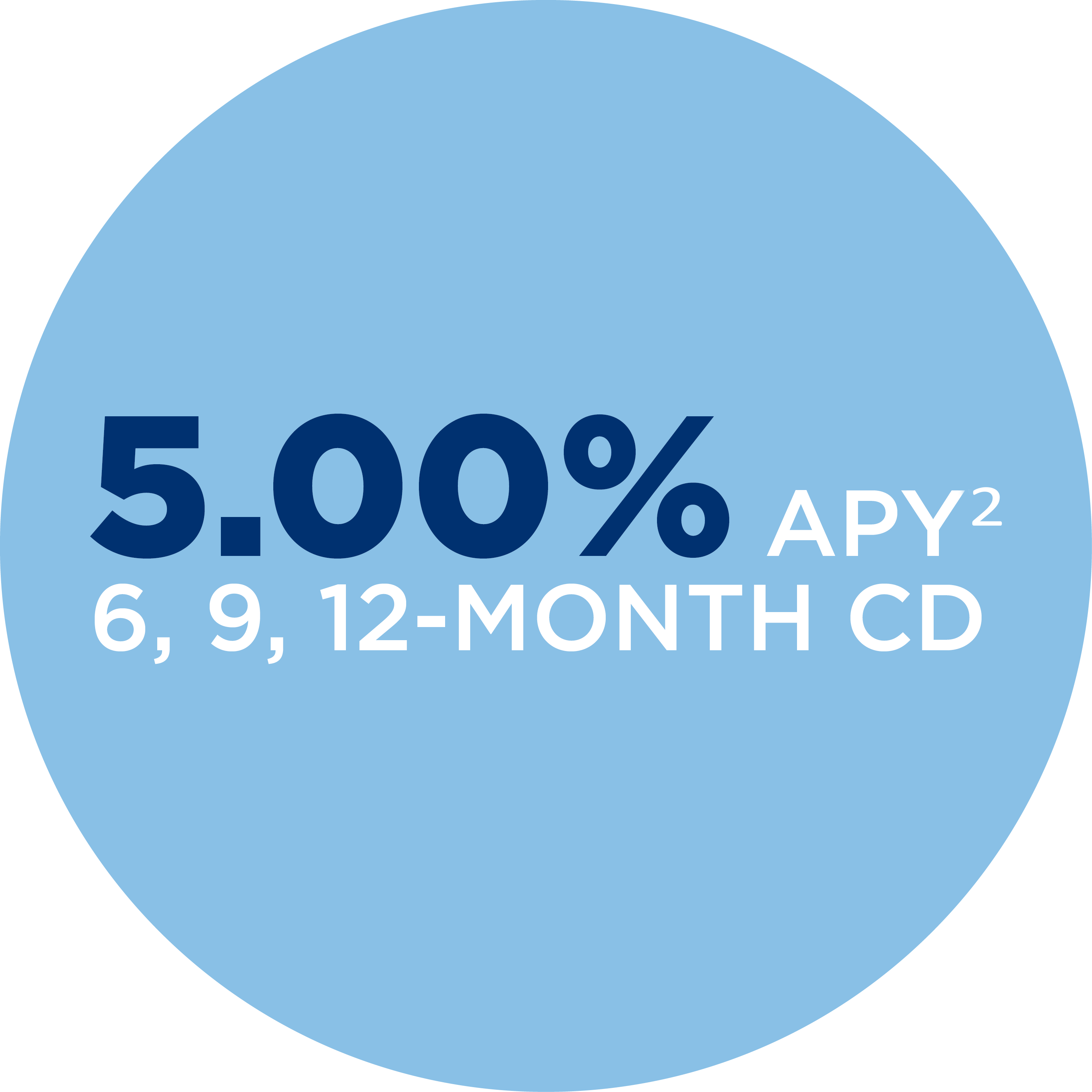

eCD Specials

High-yield Certificates of Deposit

A CD from SalemFive Direct is an easy way to be smart about your savings. There are no monthly fees and you get the piece of mind of FDIC insurance to protect your entire balance. Open an account online in just minutes.

-

FDIC Insurance

Member FDIC

FDIC insurance covers depositors' accounts, whether using a physical branch office, salemfive.com or salemfivedirect.com, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's closing, up to the insurance limit. The standard insurance amount is $250,000 per person, per bank, per ownership category.

-

FAQs

-

I've noticed that my bank displays the FDIC logo. What does Member FDIC mean?

Salem Five is a member of The FDIC (Federal Deposit Insurance Corporation). The first $250,000 per depositor is insured by the FDIC and is backed by the full faith and credit of the United States government.

-

Has any depositor ever lost money in a Member FDIC bank?

No. The FDIC has always paid deposits in full up to its insurance limit. No depositor has ever lost a penny in an FDIC member bank since it was established in 1933.

-

If a Member FDIC bank ever got into financial trouble, how would I get my money?

Based on past experience, arrangements would be made for all deposits to be automatically transferred to another bank. All your deposit funds would be available with no interruption of service.

-

Does the FDIC insure investments in bank mutual funds?

No. FDIC only cover deposits.

-

Where can I learn more about the FDIC?

Visit the FDIC website where you can access additional information.

-

I've noticed that my bank displays the FDIC logo. What does Member FDIC mean?

-

-

About Salem Five Direct

Salem Five Direct is an online division of Salem Five, an innovative bank located in Salem, Massachusetts with over 160 years of banking experience. At Salem Five Direct you will find unique products not available through the Salem Five branch network and therefore will change from time to time.

The Salem Five Direct mission is to offer exceptional value to our direct banking customers through exclusive product features at highly competitive rates.

Deposits insured by the Federal Deposit Insurance Corporation (FDIC).

Important Legal Disclosures and Information

1 eOne Savings eligibility is limited to consumers who apply online and who do not have an existing checking or savings account with Salem Five Bank at the time of the application. Consumers with an existing eOne Checking Account are eligible for the eOne Savings Account.

eOne Savings earns 5.01% APY1 (Annual Percentage Yield) on daily balances of $0.01-$1,000,000 and must be opened with funds not previously on deposit with Salem Five or Salem Five Direct. Salem Five reserves the right to transfer balances over $1,000,000 to a Statement Savings Account which currently earns an APY of .01%. eOne Savings may be used to provide overdraft protection for eOne Checking. You must deposit at least $10 to open this account. The stated APY1 applies to new eOne accounts opened as of today's date. Fees may reduce earnings.

2 Special CD Promo minimum balance to open a Special CD and obtain the Annual Percentage Yield (APY) is $10,000. Substantial penalty for early withdrawal. APY is current as of 4/10/2024 and subject to change. Maximum deposit amount is $500,000. The maturity date is the last day of your CD's term based on the date your account is opened. Interest is calculated from the day of your deposit until, but not including the day of your withdrawal. Fees may reduce earnings. Personal accounts only.